PNN

Mumbai (Maharashtra) [India], October 17: Emerald Finance Limited (BSE: EMERALD), is a dynamic company offering a spectrum of financial products and services including its flagship Earned Wage Access (EWA)in India, announced its Unaudited Financial Results for Q2 FY26 & H1 FY26.

Q2 FY26 Key Standalone Financial Highlights

* Total Income of ₹ 4.89 Cr, YoY growth of 66.21%

* EBITDA of ₹ 4.37 Cr, YoY growth of 78.53%

* Net Profit of ₹ 2.98 Cr, YoY growth of 106.98%

* EPS of ₹ 0.86, YoY growth of 95.90%

Q2 FY26 Key Consolidated Financial Highlight

* Total Income of ₹ 6.91 Cr, YoY growth of 37.85%

* EBITDA of ₹ 5.42 Cr, YoY growth of 54.80%

* Net Profit of ₹ 3.60 Cr, YoY growth of 75.47%

* EPS of ₹ 1.04, YoY growth of 66.13%

H1 FY26 Key Standalone Financial Highlight

* Total Income of ₹ 9.63 Cr, YoY growth of 76.78%

* EBITDA of ₹ 8.34 Cr, YoY growth of 90.31%

* Net Profit of ₹ 5.61 Cr, YoY growth of 120.61%

* EPS of ₹ 1.62, YoY growth of 107.61%

H1 FY26 Key Consolidated Financial Highlight

* Total Income of ₹ 13.65 Cr, YoY growth of 45.04%

* EBITDA of ₹ 10.37 Cr, YoY growth of 60.79%

* Net Profit of ₹ 6.79 Cr, YoY growth of 80.56%

* EPS of ₹ 1.96, YoY growth of 70.73%

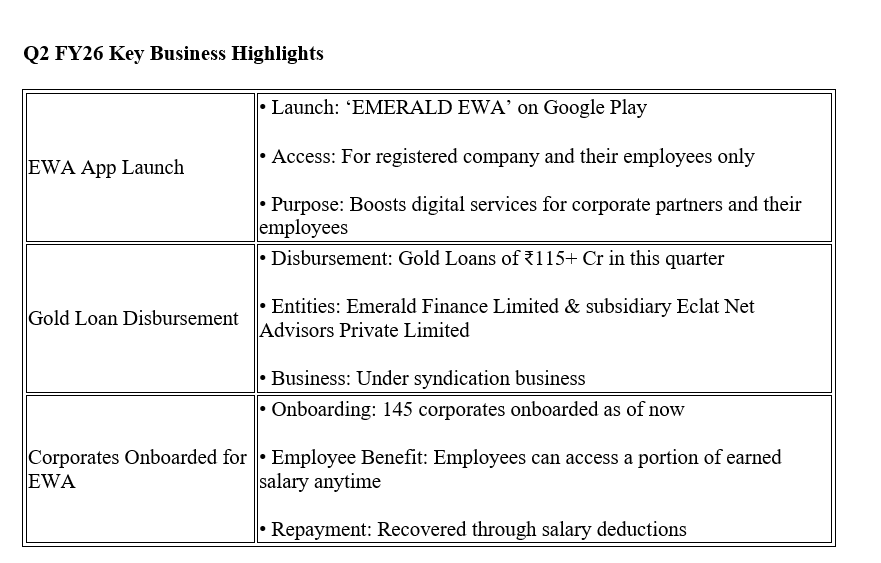

Comment on Financial Performance Mr. Sanjay Aggarwal, Managing Director of Emerald FinanceLimited said, “Q2 FY26 has been another strong quarter for Emerald Finance, reflecting sustained growth momentum across our key business segments. We have onboarded 145 corporates on our Earned Wage Access platform till date and successfully launched the ‘Emerald EWA’ mobile app on Google Play, further enhancing digital accessibility for our corporate partners and their employees. Our gold loan syndication business continued to gain strong traction, achieving disbursements of ₹115 + crore during Q2 FY26. This reflects the growing confidence of our partners and the scalability of our asset-light, technology-driven model.

India’s financial ecosystem continues to experience strong tailwinds, supported by digital adoption, rising formal credit penetration, and policy-driven inclusion initiatives. NBFCs and fintechs are at the forefront of this evolution, and Emerald is well positioned within this landscape through its technology-led, asset-light model and inclusive financial approach.”

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same.)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages