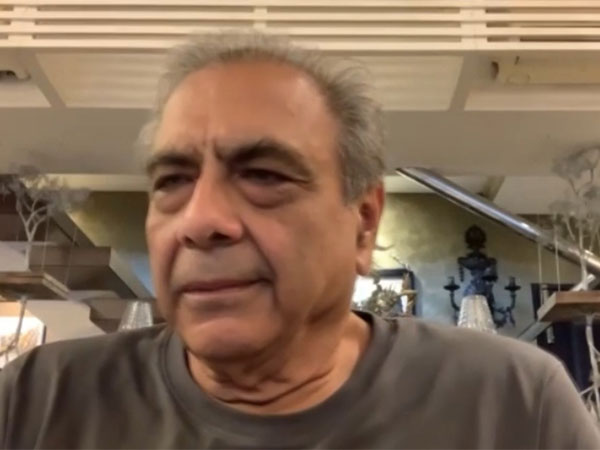

New Delhi [India], August 11 (ANI): US-based short seller Hindenburg Research, without any responsibility or accountability, sitting in America, a safe harbor, relying on third-party reports, to target India and its top public servant, says senior Supreme Court advocate and BJP Rajya Sabha MP Mahesh Jethmalani. Talking exclusively with ANI, Jethmalani said a band of conspirators had got together, circulating information to do conspiracy, with deep ramifications to damage the stock market of India.

“Your (Hindenburg’s) research is only based on some other organizations…Whether those are true or not, they’re evidentiary value, anybody can fake anything,” Jethmalani told ANI

Hindenburg, instead of responding to SEBI show cause notice, is now attacking the market regulator, chairperson of SEBI Madhabi Puri Buch, Jethmalani added.

“That means he has no answer. And he has only repeated some old stuff. What he had said in his first report, he has repeated same thing. But there is nothing new. He has only attacked the regulator and said there is a conflict of interest.”

Hindenburg, in his latest report has targeted SEBI chairperson, and alleged that there is a case of conflict of interest.

“But in fact, none seems to be there…She must file both a criminal defamation case and a civil defamation defamation case against him in India.” Advised Jethmalani to SEBI chief.

“SEBI must probe this much more deeply than they’re doing. Retail investors have lost a lot of money and this is a concerted attempt not just to rock the stock market, undermine our budget and cause reputational damage to Adani.”

Earlier in the day, in a post on “X”, BJP Rajya Sabha MP and senior Advocate Mahesh Jethmalani said that the US short seller had chosen to attack the SEBI Chairperson Madhabi Buch instead of responding to a notice from the market regulator.

“Hindenburg’s “Something big” is a pathetic damp squib. The announcement prior to its alleged big revelation itself reveals its motive: to destabilise India’s stock markets. The pre publicity ill behoves a reputed “research analyst “. As regards the “big” something there is nothing new against the Adani group,” says his post on X.

Instead of replying to SEBI’s lawful show cause notice Hindenburg chose to target the the regulator- SEBI -Chairperson Madhabi Puri Buch.

” Instead of responding to the show cause notice, Hindenburg has chosen to attack its chairperson on the ground of conflict of interest (more on the grounds on which the attack is based after Ms Buch issues a detailed statement as announced; suffice it to say that the grounds are prima facie rubbish),” Jethmalani said.

The senior advocate also urged the Indian government to take serious note to those who are looking to devastate the Indian economy.

“The picture thus is one of a US-based profiteer who made millions of dollars at the cost of Indian retail investors now hedging questions legitimately asked by the Indian regulator and brazenly defaming the latter without answering its questions. This reeks of colonial arrogance of days bygone and contempt by a rich country national fortified by safe harbour, of the economic sovereignty of an Emerging nation.”

Jethmalani also targeted left leaning media groups who have no other agenda than to defame the government.

“And as is to be expected a host of left-leaning media outlets – slaves to foreign masters all and wannabe rulers with their help- have called for Ms Buch’s head. It is time, the govt of the day turned its serious attention to these anti nationals who have no other agenda but to disrupt India’s social fabric, distort its polity and now devastate its economy,” Mahesh Jethmalani said in his post on X.

Earlier on July 19, Jethmalani had called on the government to probe the links of political voices, who sought to target the Adani group after the Hindenburg report, with China. He had also flagged an alleged Chinese hand behind the report by the American short seller Hindenburg that targeted the Indian conglomerate.

Jethmalani alleged that the hit job on the Adani group was Chinese vengeance for losing out on infrastructure projects like the Haifa Port.

The Adani group too has also rejected the latest allegations by Hindenburg calling them a manipulation of informations.

“The latest allegations by Hindenburg Research are malicious, mischievous, and manipulative selections of publicly available information to arrive at pre-determined conclusions for “personal profiteering with wanton disregard for facts and the law”, an Adani Group spokesperson said on August 11, hours after the US-based short seller shot off fresh allegations.

“We completely reject these allegations against the Adani Group which are a recycling of discredited claims that have been thoroughly investigated, proven to be baseless and already dismissed by the Hon’ble Supreme Court in January 2024,” the Adani Group spokesperson informed stock exchanges in a filing dated August 11.

SEBI Chairperson Madhabi Buch and her husbands too through a press release rejected the allegations of Hindenburg as baseless and malicious and said this is done for their “character assassination.”

In the joint statement released to the media they said, “Our life and finances are an open book. All disclosures as required have already been furnished to SEBI over the years. We have no hesitation in disclosing any and all financial documents, including those that relate to the period when we were strictly private citizens, to any and every authority that may seek them. It is unfortunate that Hindenburg Research against whom SEBI has taken an Enforcement action and issued a show cause notice has chosen to attempt character assassination in response to the same.”

On August 10, Hindenburg published a report alleging, “We had previously noted Adani’s total confidence in continuing to operate without the risk of serious regulatory intervention, suggesting that this may be explained through Adani’s relationship with SEBI Chairperson, Madhabi Buch.”

“What we hadn’t realized: the current SEBI Chairperson and her husband, Dhaval Buch, had hidden stakes in the exact same obscure offshore Bermuda and Mauritius funds, found in the same complex nested structure, used by Vinod Adani,” the report by the US hedge firm alleged.

Earlier in January 2023, Hindenburg has published a report accusing the Adani Group of financial irregularities, leading to a significant drop in the groups stock prices. Adani had rubbished these claims as baseless.

The Supreme Court has given a clean chit to the Adani group. In January 2024, the apex court refused to transfer the probe into the allegations made by Hindenburg of stock price manipulation by the Adani group to an SIT and had directed market regulator SEBI to complete its probe into two pending cases within three months.

In June this year, the Supreme Court has also dismissed a plea seeking to review its earlier verdict in the Adani-Hindenburg case. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages